|

What does this mean for you?

|

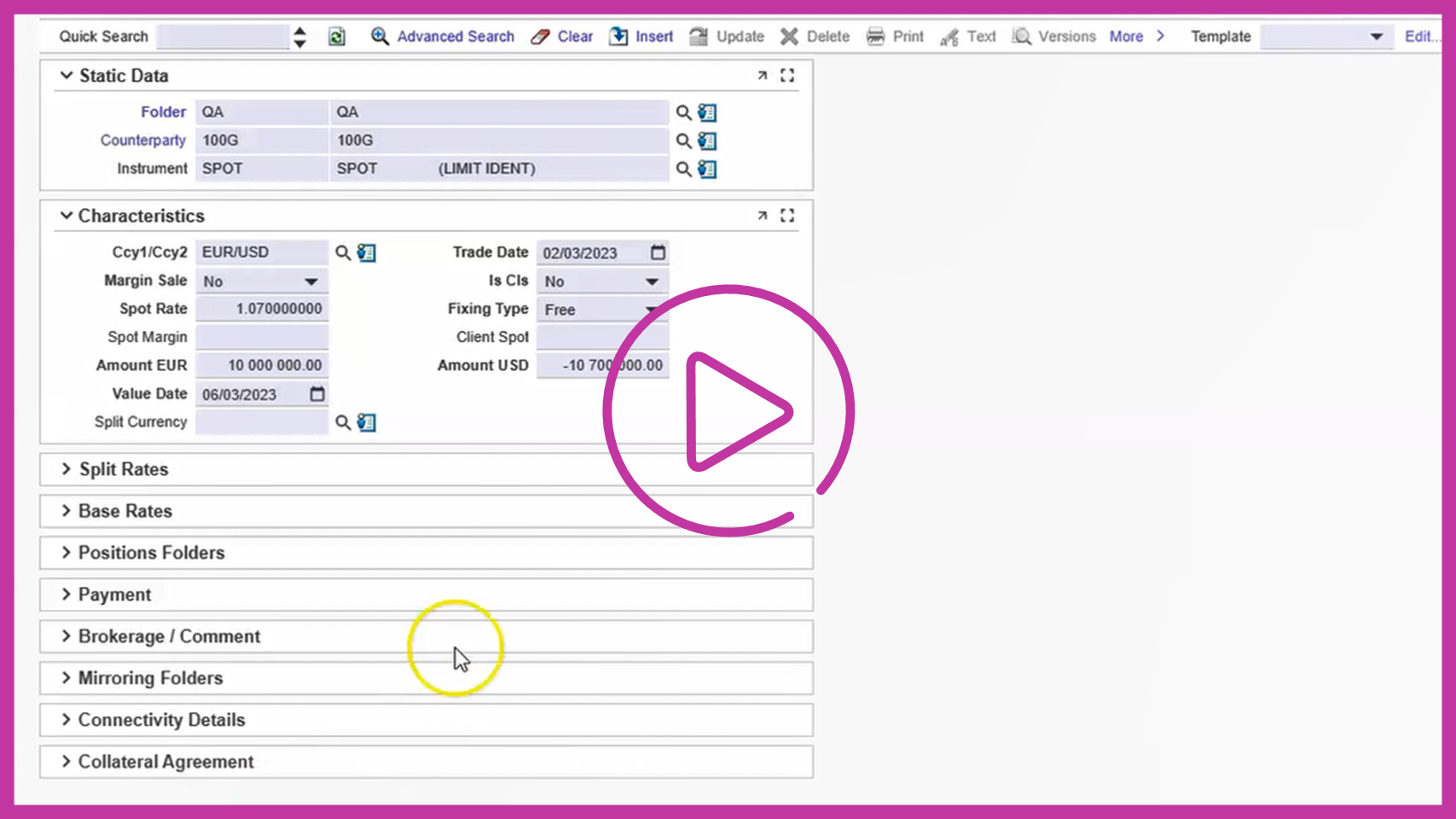

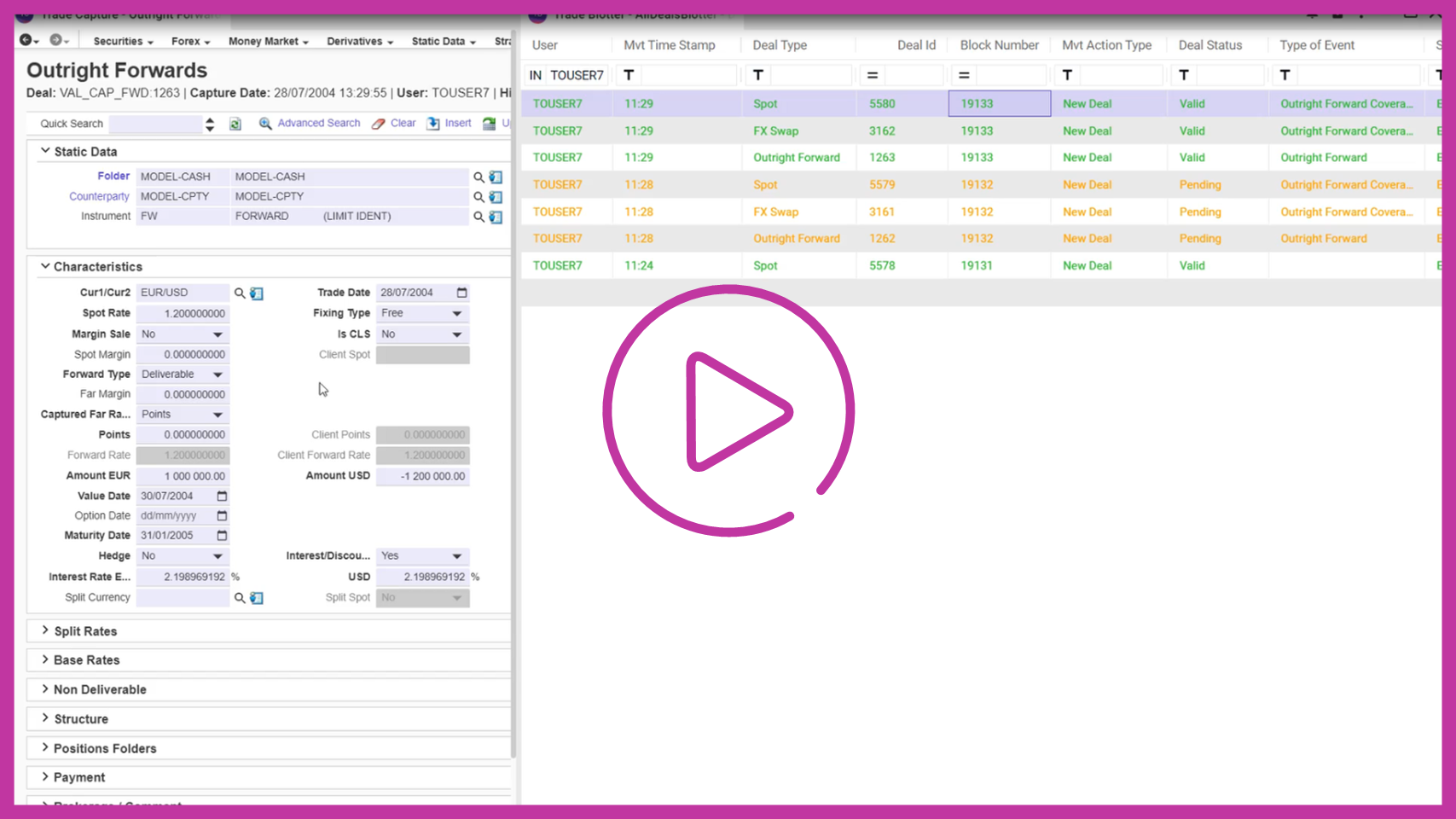

Key Features

|

|

|

|

|

Cutting-edge reporting and dashboarding provide reports in the formats you need |

Fully integrated modern technology for dynamic updates all throughout |

Easy to customize workspaces that you can save and share |

|

|

|

|

|

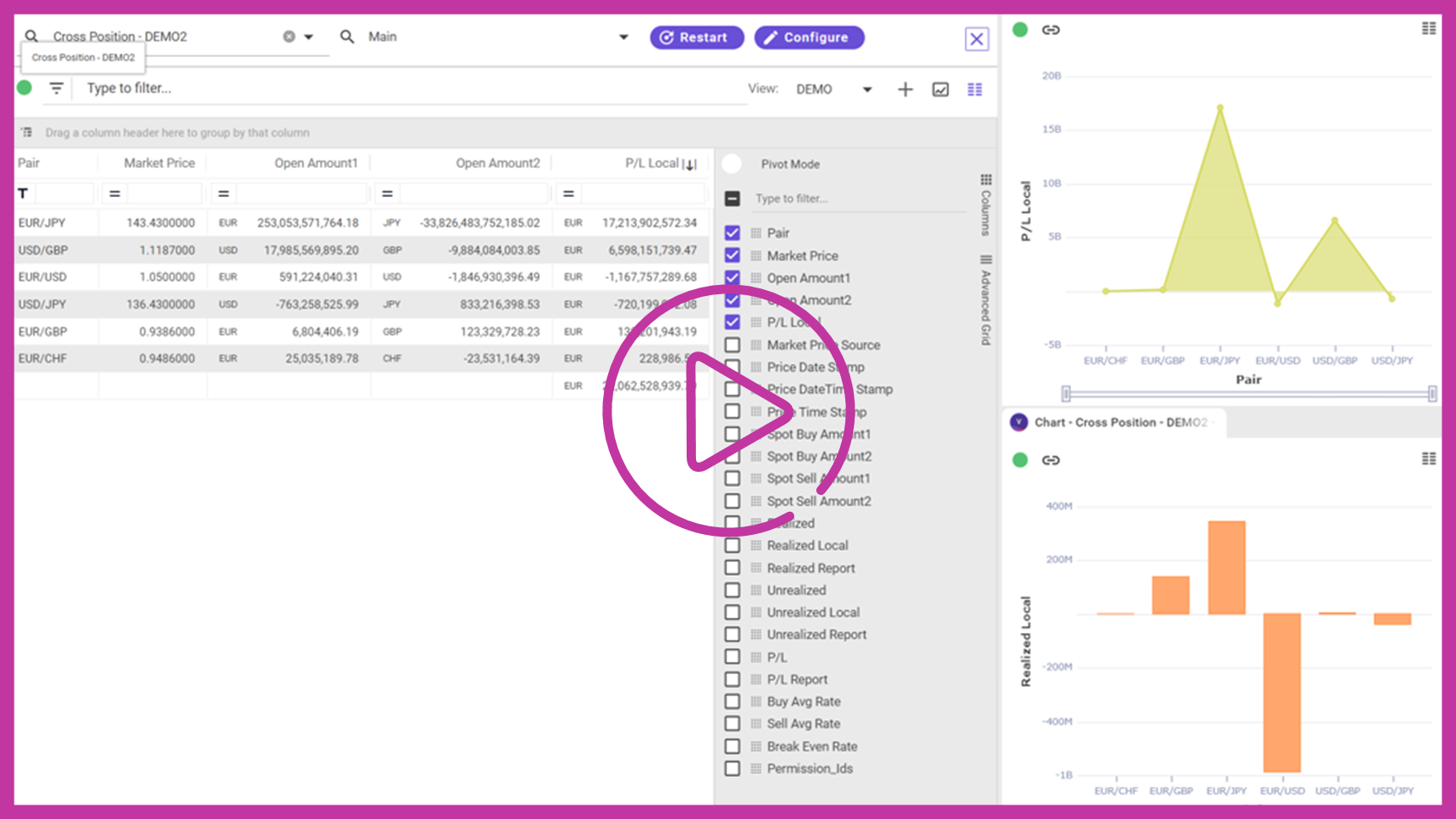

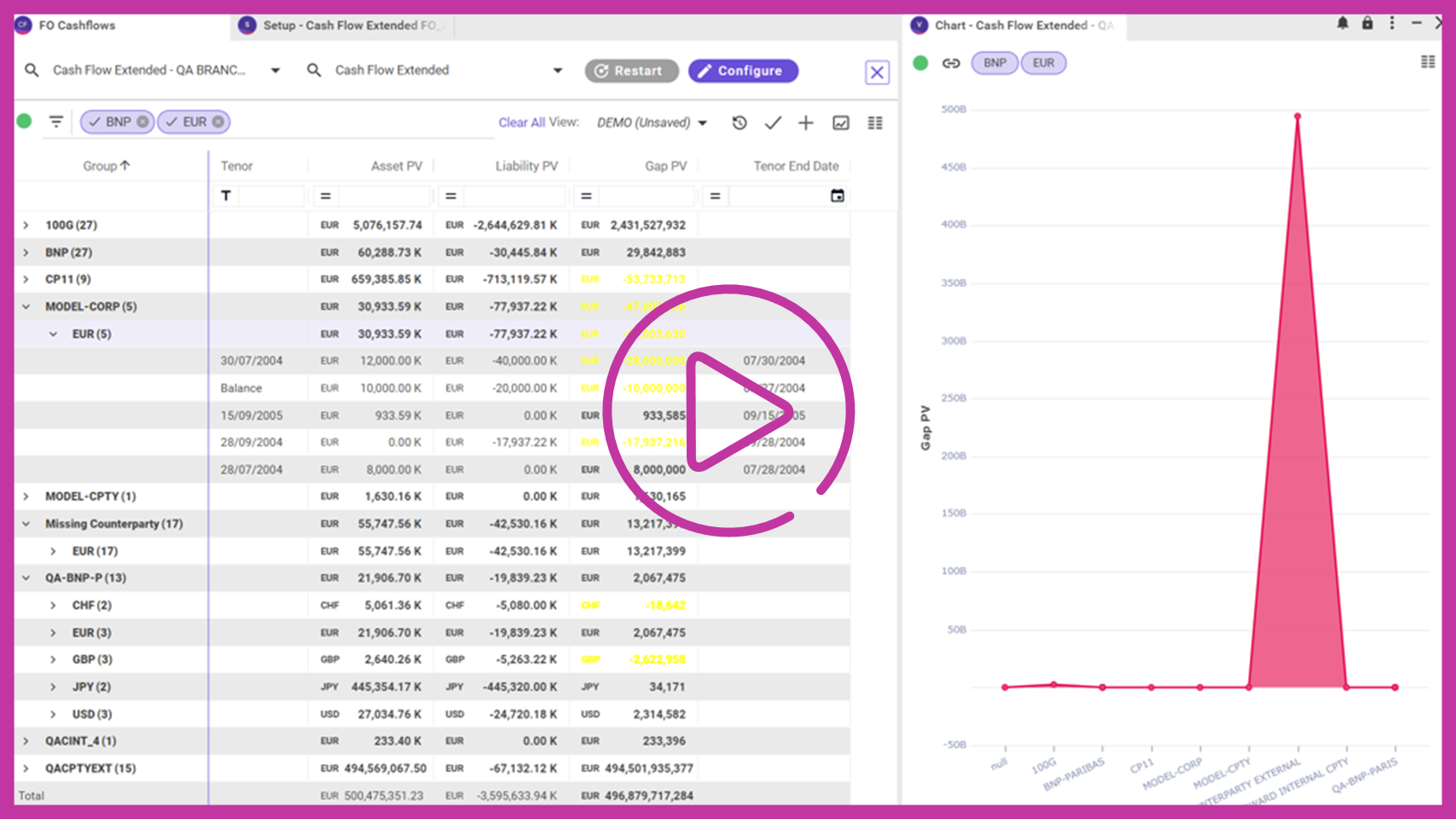

Powerful dashboards that can be extended with custom analytics |

Extensive export capabilities in many formats including Excel, JSON, CSV, Clipboard, and others |

Great performance and data updates available in real time |

Spotlight on Kondor 3.5 Applications

|

|

|

|

||||||||

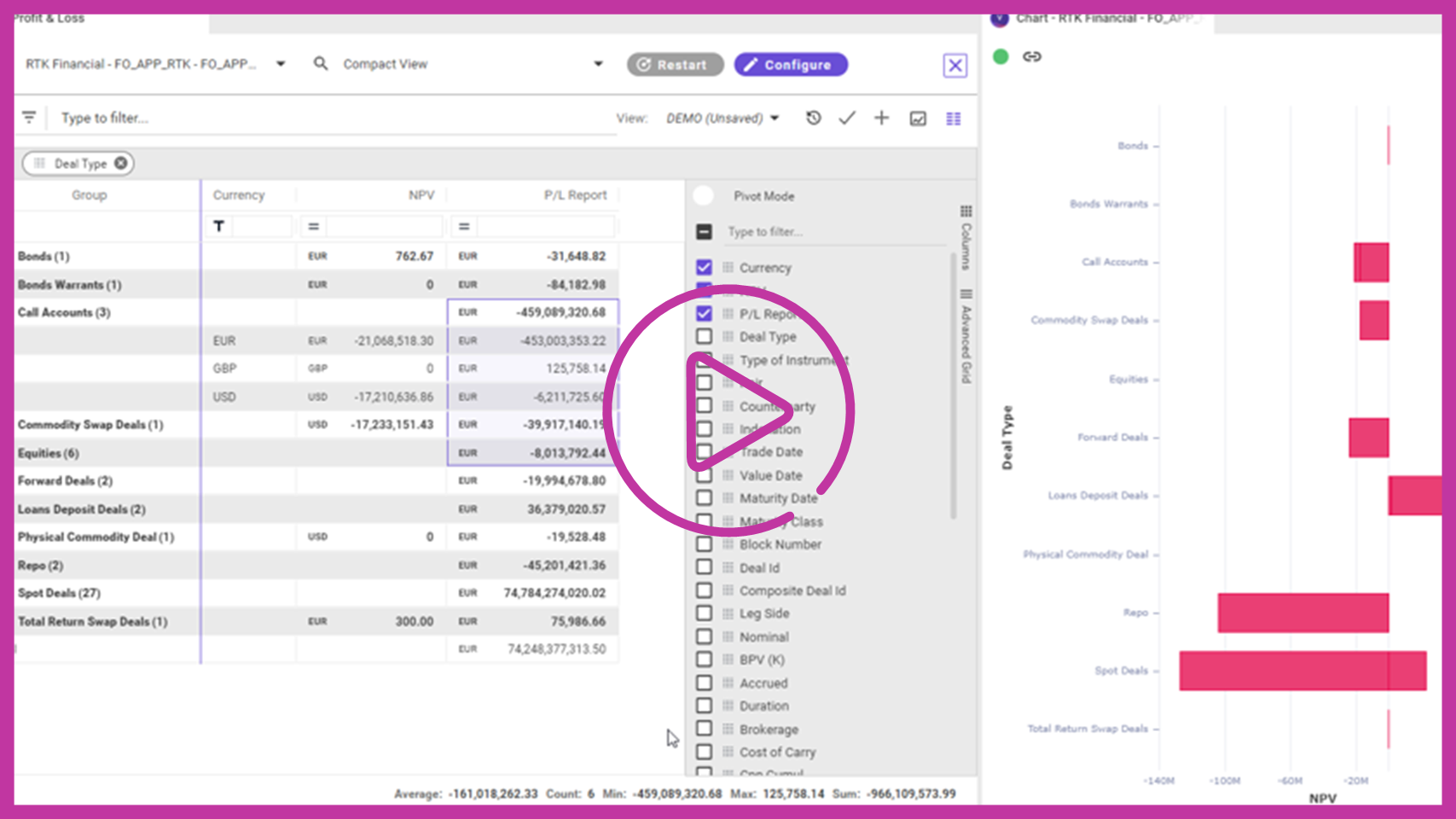

Profit & Loss |

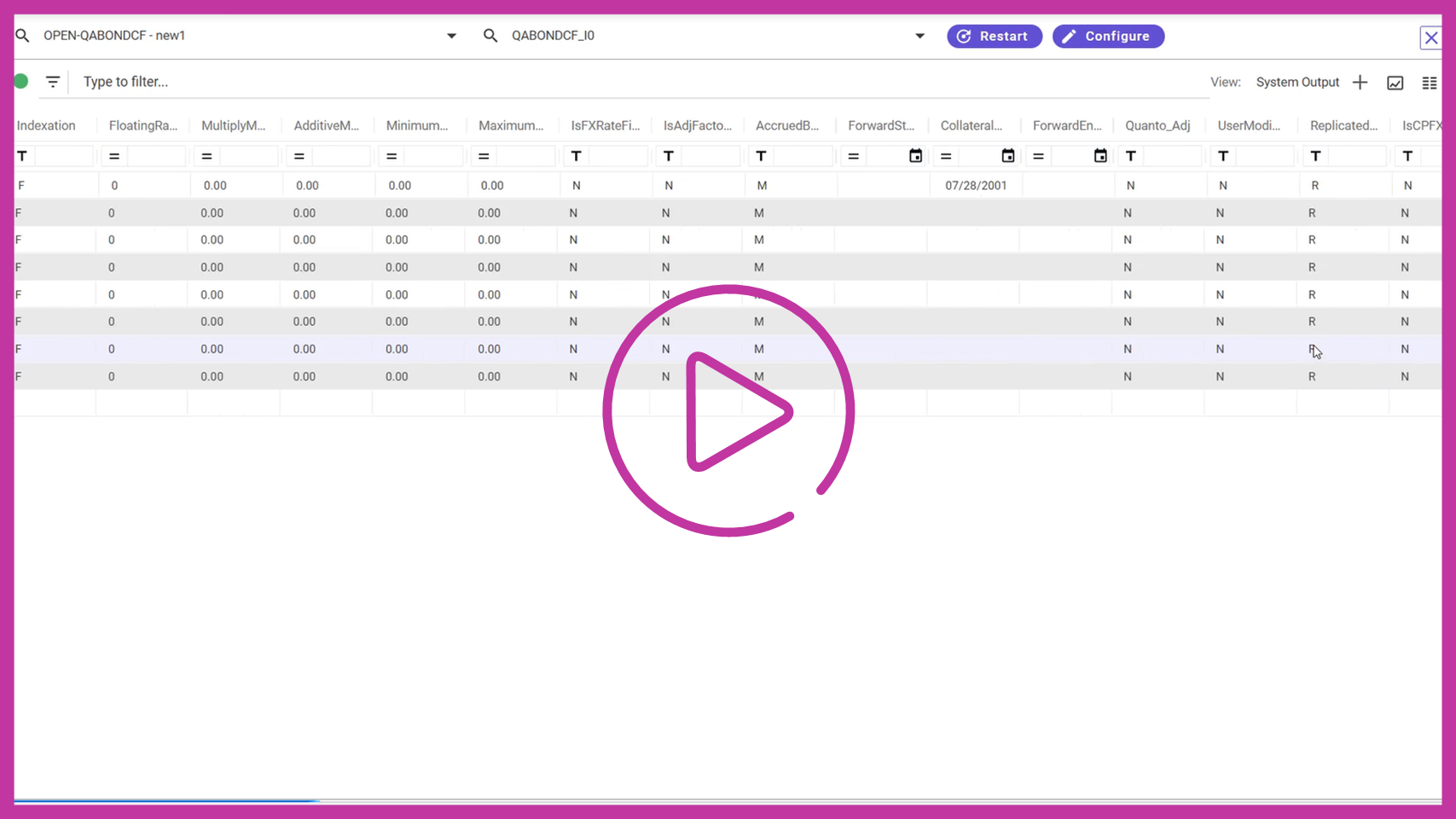

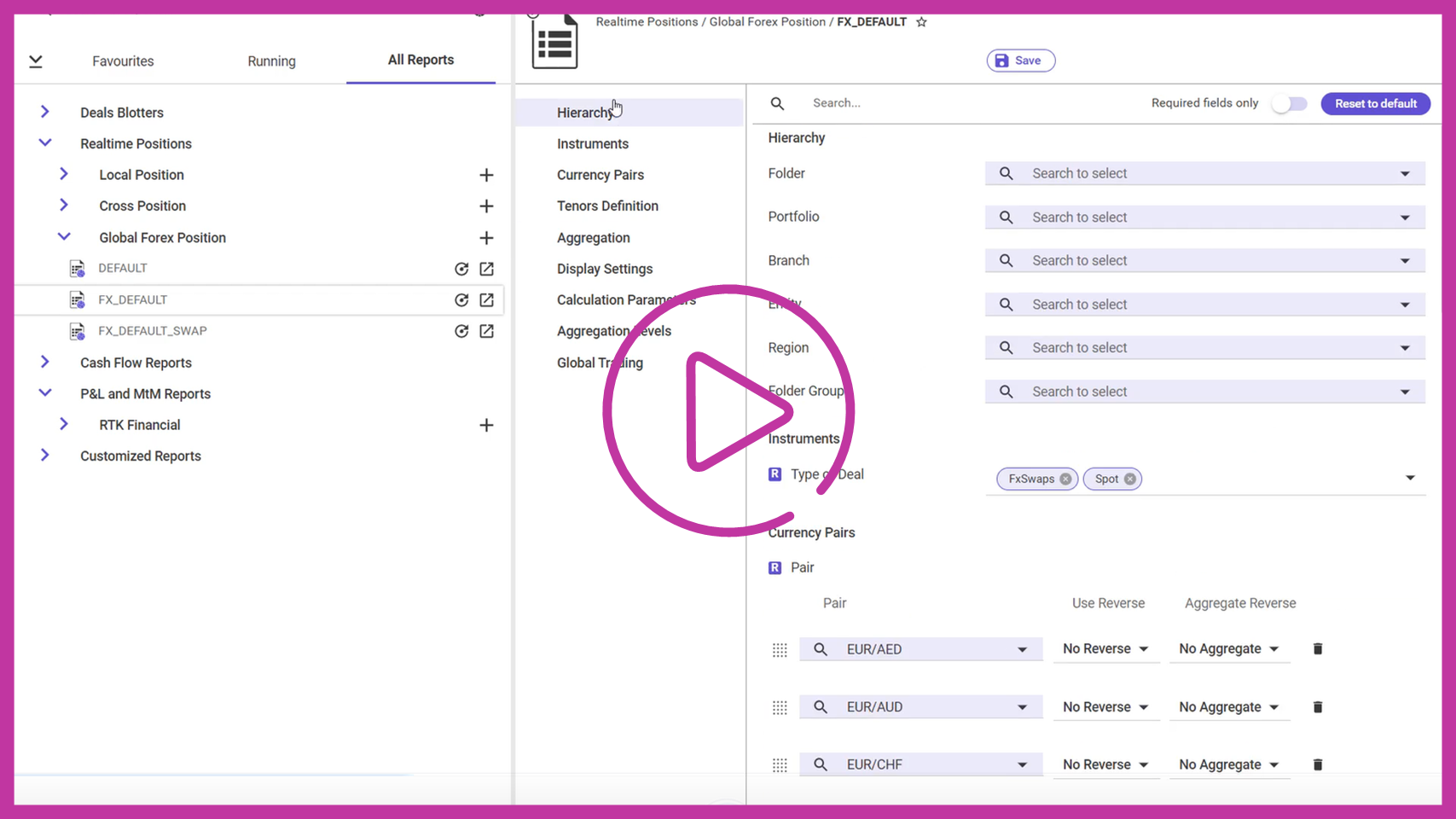

Custom Reports |

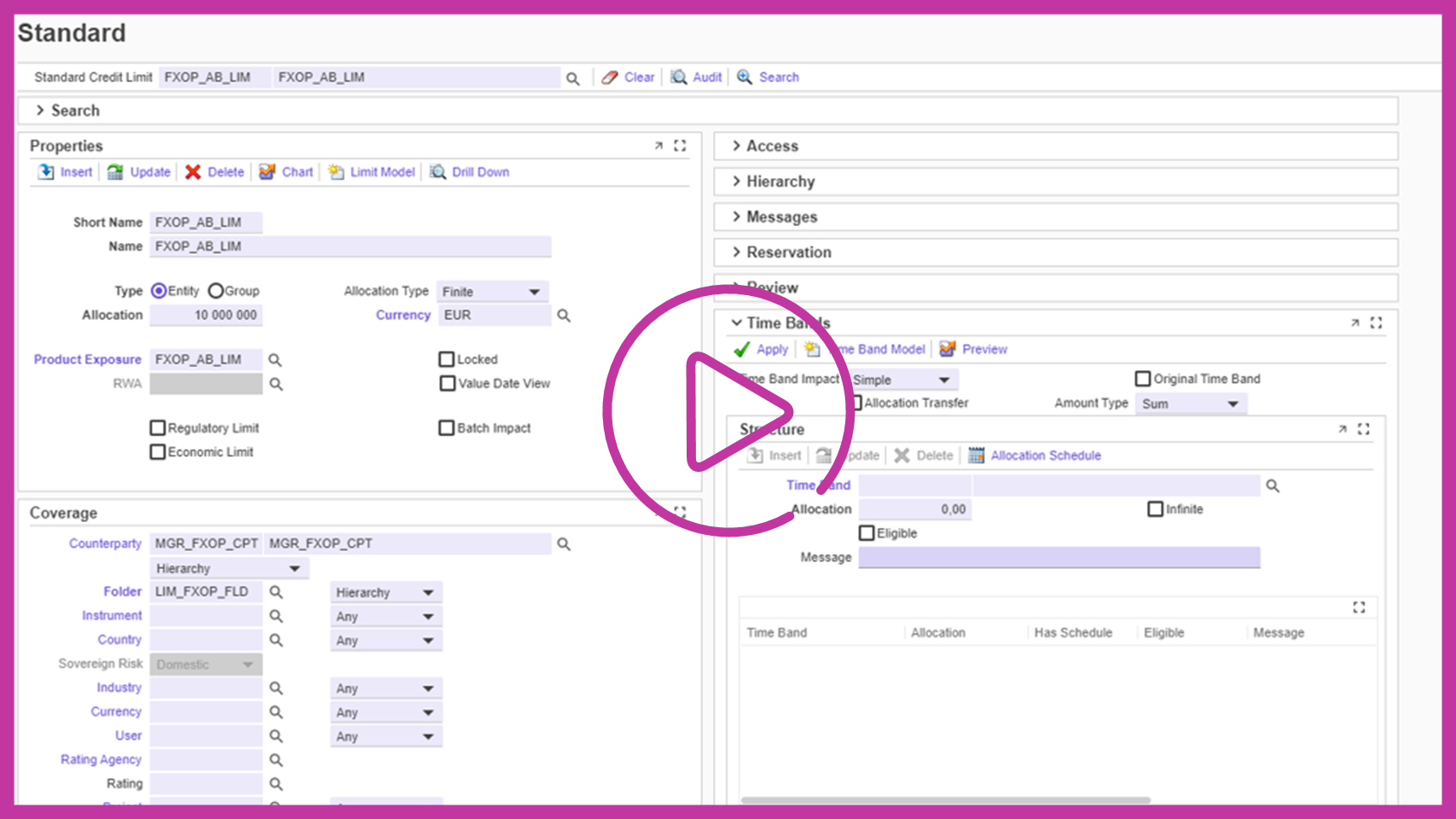

Risk Set-up & Limits |

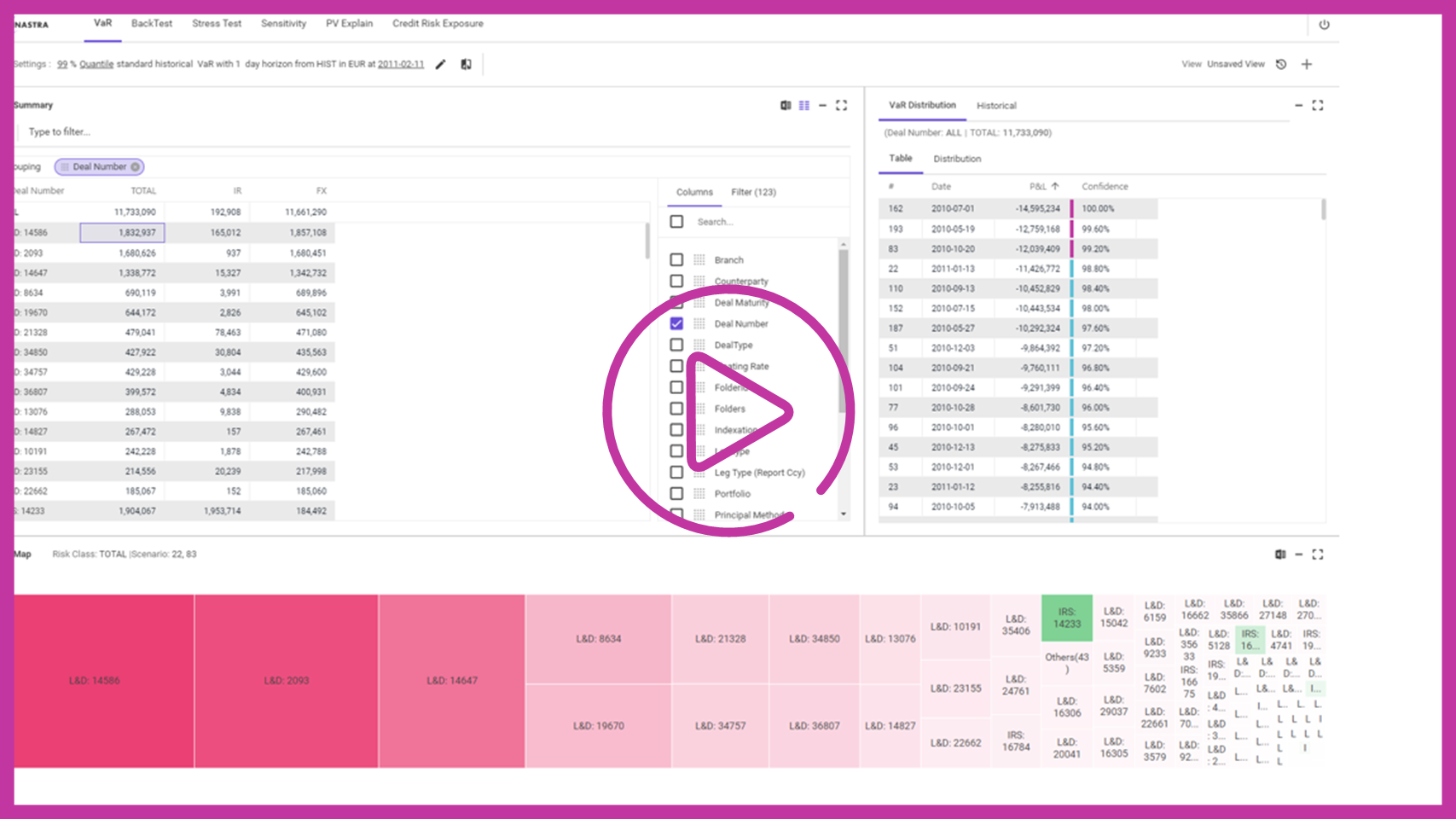

Market Risk |

||||||||

|

The Profit & Loss application provides a comprehensive view of the PnL and a large set of analytics on your global portfolio. |

The front office custom reports offer Open and KSQL reports with built-in filtering and slicing capabilities. |

The Risk Set-up & Limits application allows you to set up Credit Limits and configure Risk Reports. |

The Market Risk application provides reports that can be used to monitor and explain market risk across the bank portfolio. |

|

|

|

|

||||||||

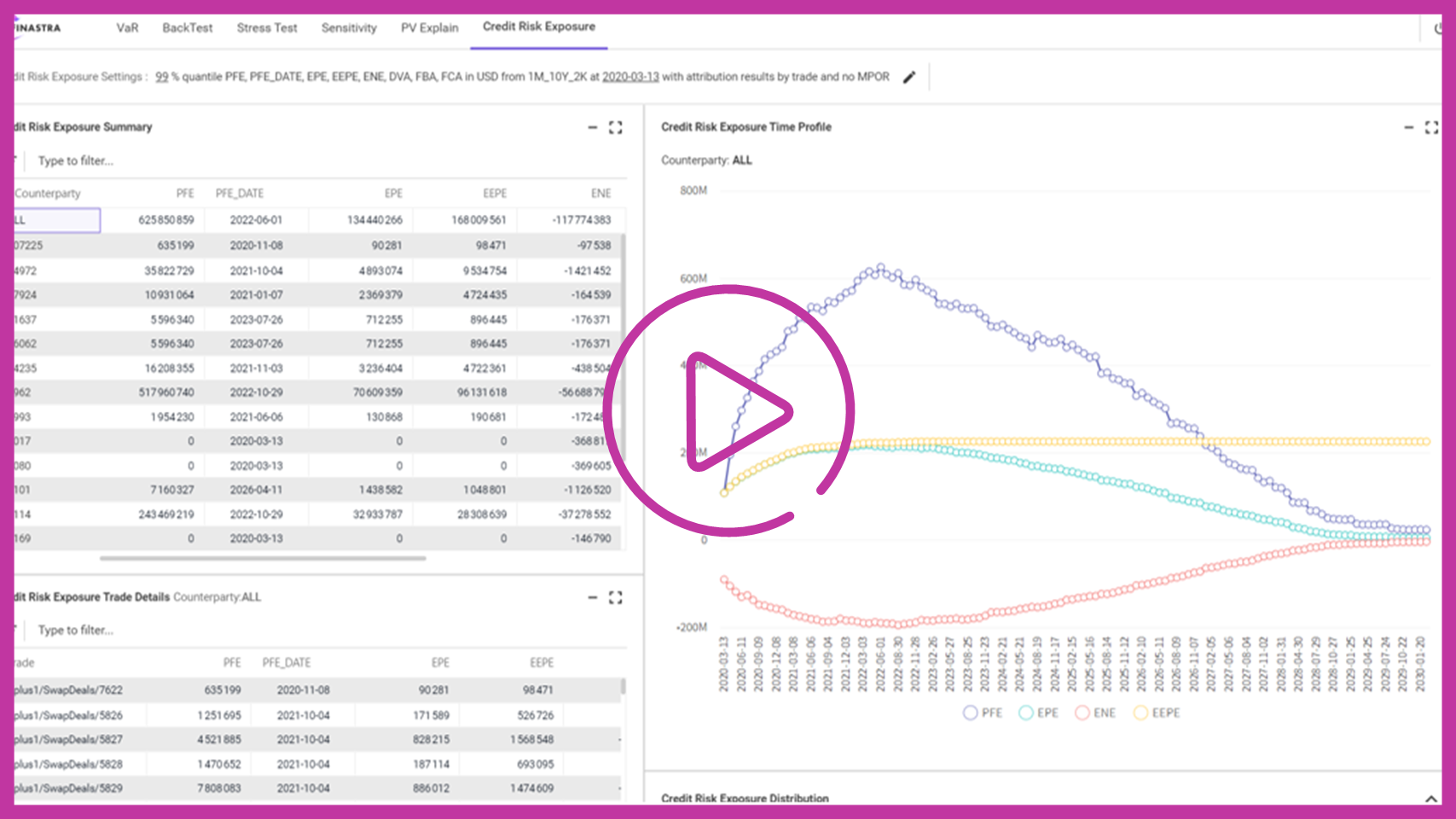

Credit Risk |

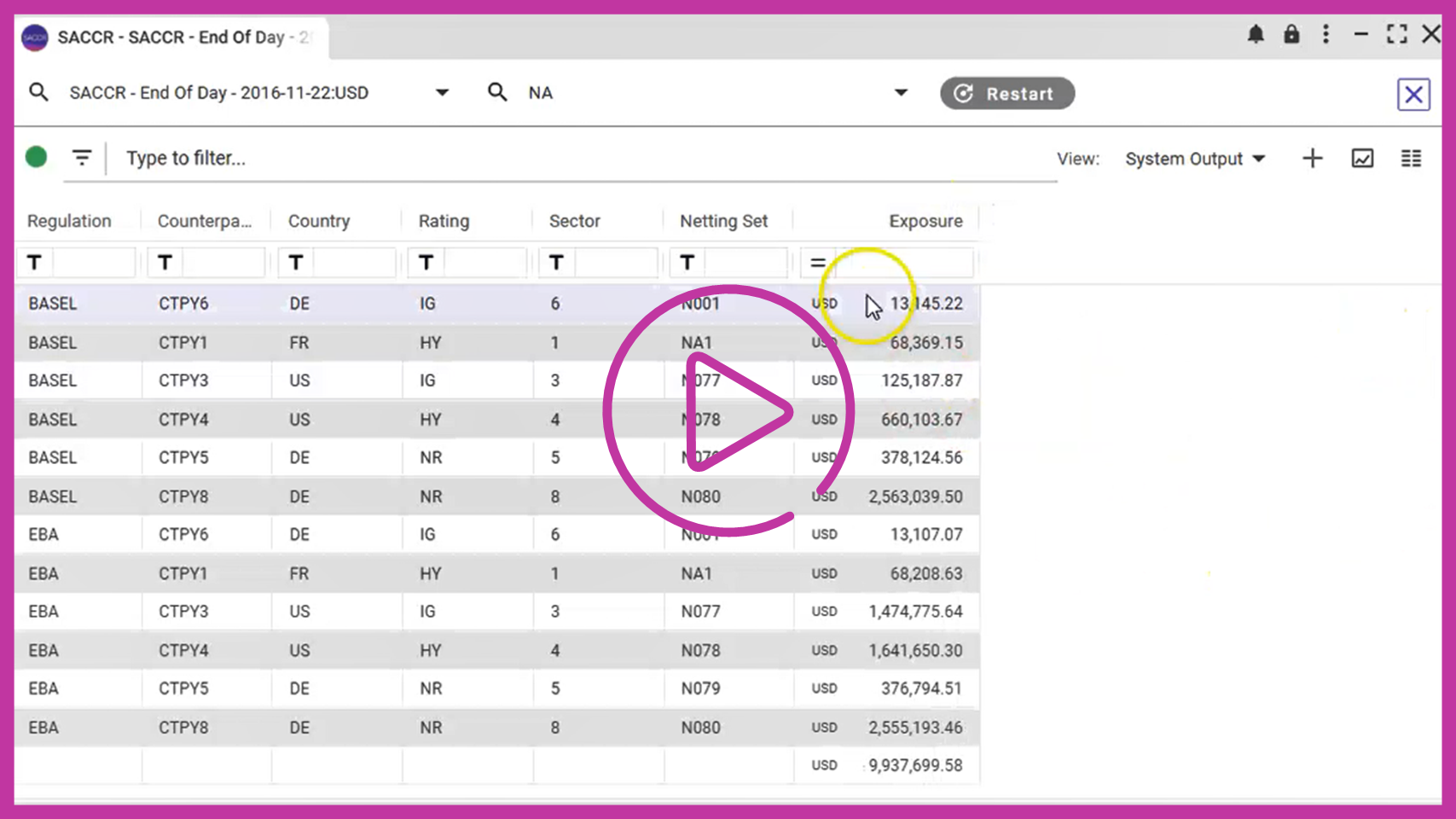

SA-CCR |

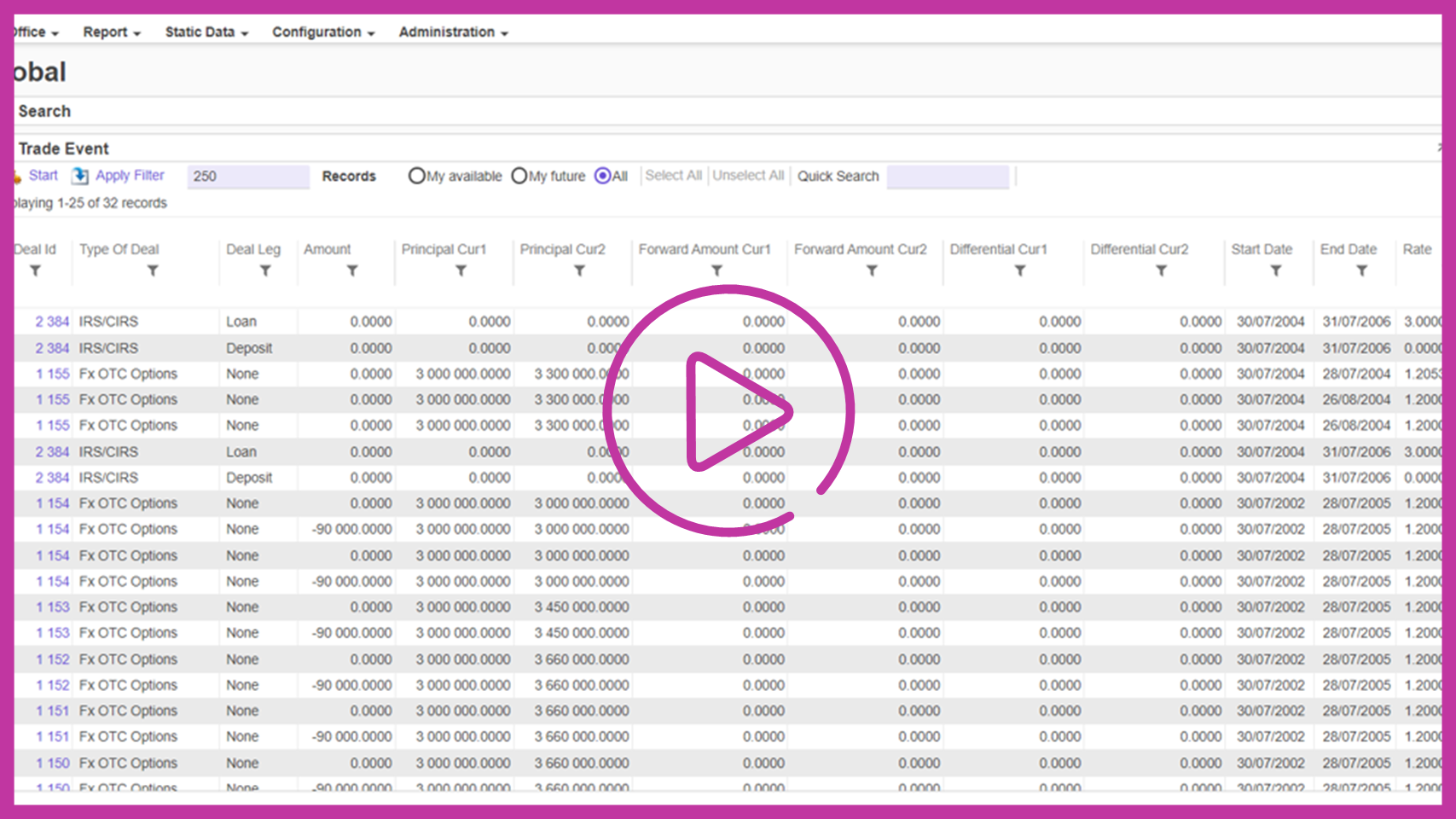

Back Office |

Kondor Reports |

||||||||

|

Credit Risk provides analytics such as Monte Carlo Counterparty credit risk exposures and xVA reports. |

The SA-CCR application provides Basel IV SA-CCR monitoring and regulatory reporting. |

Back Office includes post-trade processing, confirmation, and settlement operations. |

The Kondor Reports application allows you to visualize, edit, and run Kondor Report Configurations. |

|

|

|

|

||||||||

DV01 |

FRTB |

Back Office 360 |

Limits 360 |

||||||||

|

The DV01 application provides IR delta values. You can define a curve view and the delta values are in reporting currency. |

The FRTB application provides all the necessary analytics to meet FRTB requirements, and calculating the amount of regulatory capital you must hold, based on your market risk exposure. |

Back Office 360 displays only the data you are responsible for and allows you to interact with it, you can inspect the events, manage the data linked to them, and to perform validations according to your requirements. |

Limits 360 is a tool to define trading and market limits according to your needs. This custom view allows you to configure the limit coverage by specifying lists of filtering conditions on static data and define simple or dynamic structures of allocation amounts, that can vary based on different combinations of dimensions. |

Spotlight on Partner Applications

|

Collateral Management

Cloudmargin provides comprehensive collateral management integrated with Kondor.

Ready to learn more? Request a demo by filling out the form above, or email us at [email protected].